TLDR: Financial institutions spend untold billions every year on arbitrary opulence, trivially automatable administration and lush compensation for managers whose contributions are statistically insignificant. Monumental savings are readily achievable to get everybody a far better deal.

Blood boils in my veins whenever I deal with my bank.

This is not because of the nature of finance.

Banks are not evil, but they are outdated, and due for massive overhaul to something leaner. There are few innovation-poorer industries.

More precisely, they are innovative in creating new products, but not when it comes to internal processes.

This may appear baffling, but it makes perfect sense. There has been virtually no pressure to slim down. There’s a broad understanding that a genuine optimisation of operations is not in anybody’s interest (as it would result in an arms race) and emerging competitors such as super-lean mostly-online banks and peer-to-peer lenders do not yet have the requisite mass credibility and market share to be a challenge. But they are on the way to be.

We live in an age of sweeping decentralization, when all sorts of protected niches are under tremendous pressure due to instant global communications and an open market where a farmer in Tennessee can literally borrow money from a guy in India within five minutes of finding the offer of his local bank lacking – which is more often than not likely to be the case. This trend is only going to pick up more steam.

On a general note, the workings of banks are an example of what happens when you have an organization swimming in cash and benefiting from a situation of practical monopoly. On this, they almost challenge the wastefulness and arbitrary opulence of governments.

For clarity, let’s disassemble banking into two parts:

Retail banking:

This is the everyday kind – an account where your income goes, and where your expenses are covered from. ELI5.

Then there is somebody taking out a mortgage, a business loan or anything of the sort, who borrows the money deposited by other people into the bank.

Aside from the market failure that poorly incentivised regulation has, for the most part, made worse, there is, surprisingly for an industry based entirely on numbers, a culture of waste. This includes in no particular order:

- Physical infrastructure. Opulence was good marketing for banks when they needed to convince clients that they will not pocket their money and skip town. Today, however, credibility is based on legal and regulatory instruments rather than anchor-investments, and making huge expenses to demonstrate long-term plans is unnecessary. In effect, banks are impressing you (and, being all too human, the managers indulge their narcissism) with your own money. Not cool.

- Staff. Thousands of clerks doing what a piece of code can do. Thousands of analysts doing what random choice was repeatedly shown to do better. Not cool.

- Pay. Colossal remuneration of the banks’ top management regardless of performance (which is in reality largely outside their control), or indeed despite it. This gets worse in investment banking and fund management, as Warren Buffet pointed out. Not cool, either. The official justification is the need to retain the best talent, but I call bullshit. “Talent“ in this sense tends to mean “Contacts inside publicly traded companies”.

None of these things contribute to the quality of services.

There is something even worse than peacock spending – the fact that retail interest rates are what they are because they can. Real competition is nonexistent, save for the occasional advantage in one service balanced by a proportional disadvantage in another, with no real choice in aggregate. This is dressed in splendid marketing, but amounts to typical confusopoly.

This is not capitalism, this is oligopoly and rent seeking – the opposites of free market. Banks‘ business models cannot be defended on grounds of free market principles, being themselves in violation of them.

Reduction of waste alone would mean substantially better conditions for both borrowers and lenders. Combined with disruptive competition providing real supply and demand dynamics – an actual market – the potential benefits are spectacular.

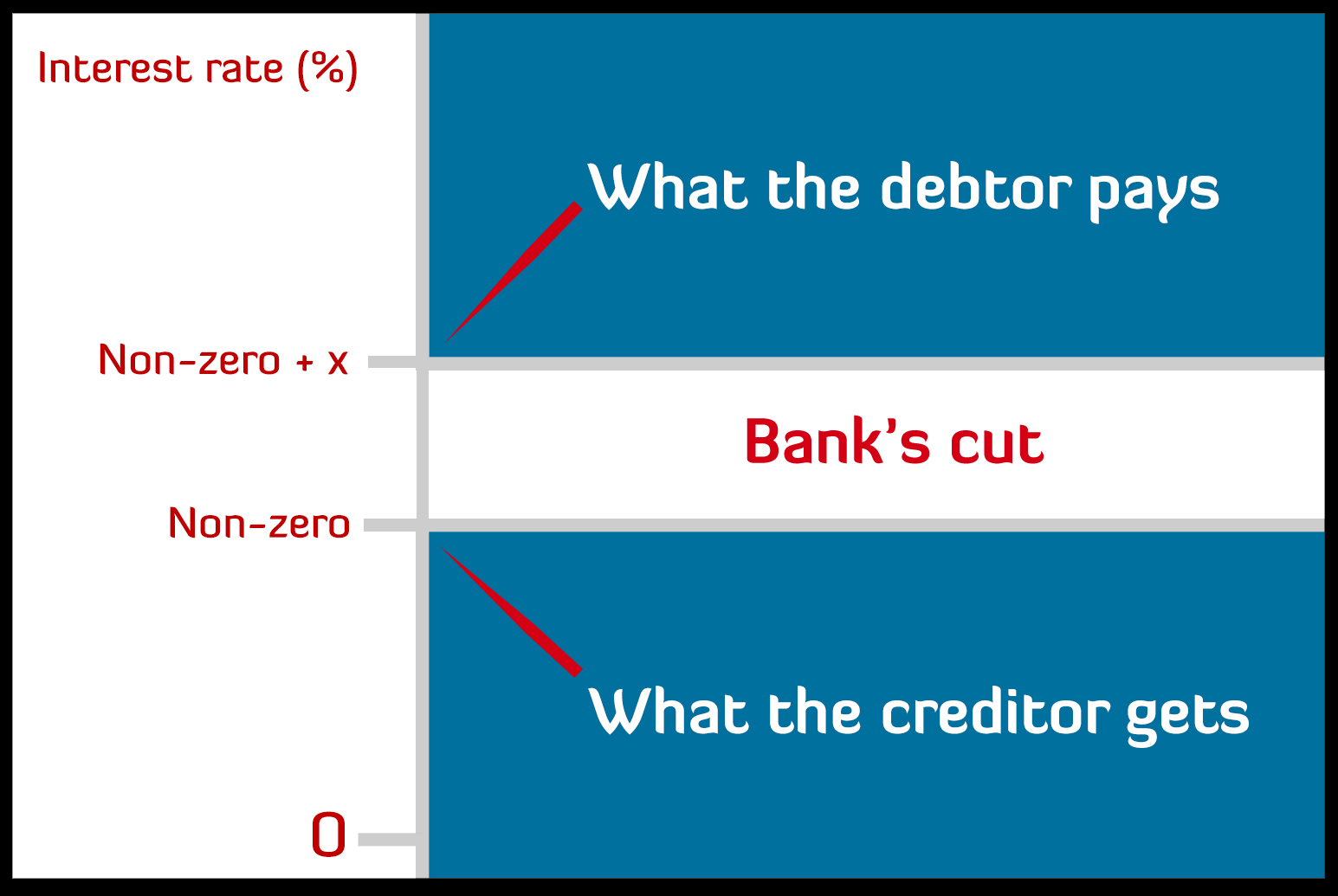

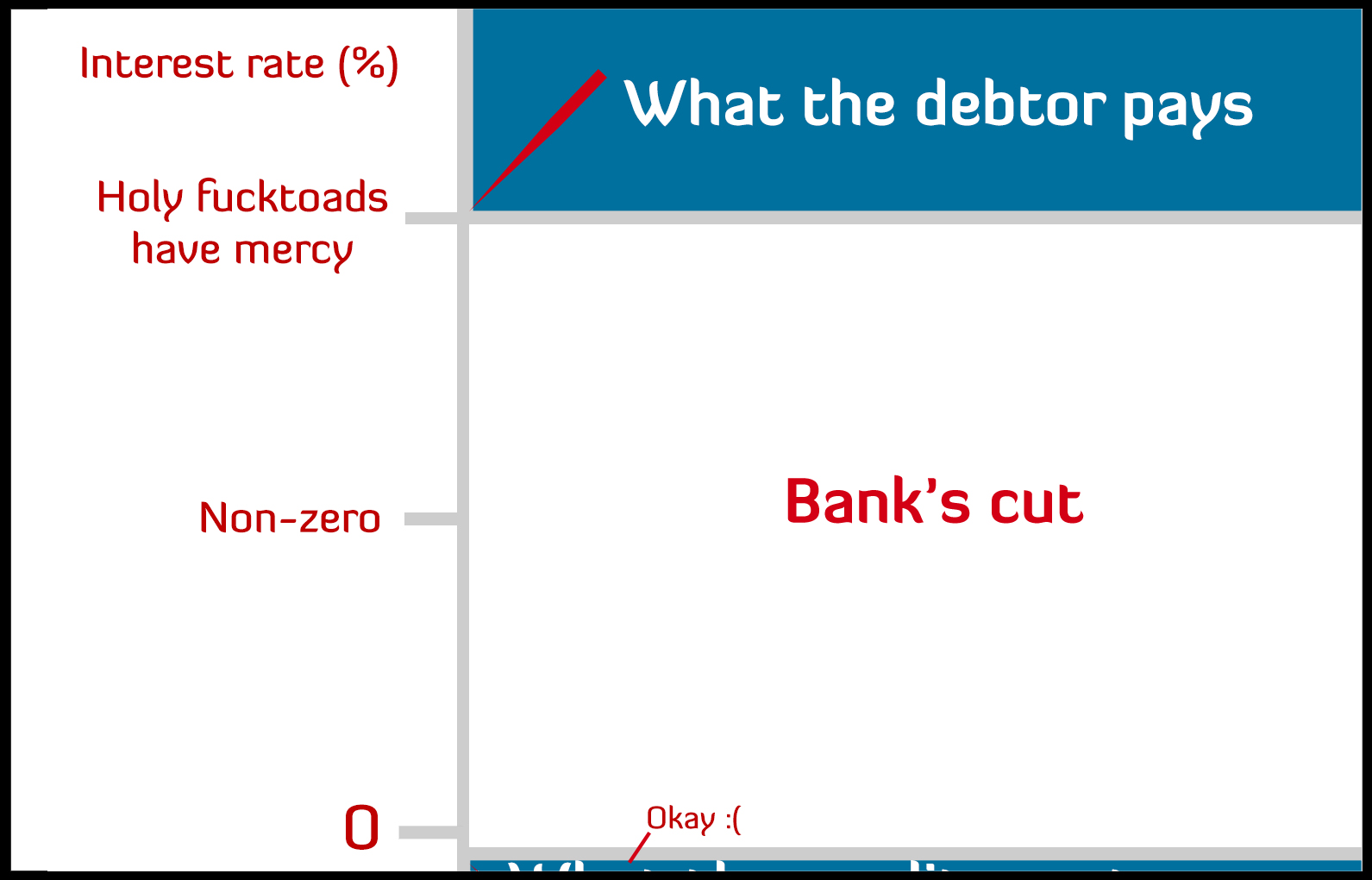

In theory, banks are meant to reward depositors for providing capital. Unfortunately, interest on deposits in developed countries is currently near-zero or, counting inflation, sub zero. In effect, you are paying the bank to take your money and lend it to somebody else at a profit. Consider the following awesomely precise graphical representation of the structure of interest rates in banking:

What is intended:

What is actually the case:

Most of the benefit accrues to the middleman – which just does not happen in functional markets.

The entire point of a bank is to connect supply of capital (savings) with demand for capital (loans).

That’s it.

In the world of “how things were intended to work”, banks are brokers, whose role is to connect buyers and sellers. They are meant to own nothing, and they are certainly not meant to appropriate the overwhelming share of the economic surplus. Hence, by the way, the rivalry between governments and financiers.

Private banking and asset/wealth management

This will run violently contrary to popular sentiment, but “the rich” are as much victims of financial tomfoolery as everybody else, and getting apocalyptically shafted by their “wealth managers”.

I am going to assume we all understand that some people deserve to be wealthy owing to their contributions to the economy (and therefore other people), while others less so. Here lies the gist of my beef with much of the upper-end financial industry, be it private banks, hedge funds, brokerages, wealth managers or any of the other sleazes who home in on cash like sharks on a wounded lamb. In essence, they shaft legitimate wealth to create illegitimate wealth. The honest wealthy, seeking safety and reasonable returns on the fruits of what is often a lifetime of hard work, are getting buttraped by con artists, whose sole qualification appears to be the ability to not visibly drool on their Hermés ties while looking at your accounts.

It is important to remember that private bankers are salesmen, not your friends, and their loyalty lies with the bank, not the client. Your loyalty is secondary, and only a goal to the extent it serves the primary objective of making money off you.

My basic objection to private banking is that its main function is not to generate returns for the clients, as should be expected, but to convert client money into bank money – a less legitimate, because less productive and productively deserved form of wealth.

To be fair, Swiss banks in particular also perform the inverse role. Turning the slush funds of third-world dictators into cheaper mortgages and small business loans that benefit the economy is an ingenious form of recycling.

Unfortunately, their effect on legitimate wealth is precisely the opposite – not least because honest clients can not be expected to dump their private banker to the bottom of Lake Zurich in a barrel of acid in case of dissatisfaction with their services, and are therefore automatically given a worse deal than those who can and will.

The core business of investment banks are management fees from proprietary investment funds. Conflict of interest is therefore inevitable and rampant, since clients are more or less subtly nudged into potentially inferior products to generate income for the house. There are few enough people affected by this that it is not a huge public topic, but it is where a significant share of the wealth of developed economies goes to turn into bubbly valuations of real estate and expensive shoes in the banking centers of the world.

Further, to discourage independent investment and herd clients into the aforementioned proprietary products, investment banks charge trade comissions an order of magnitude above discount brokers – single digit percent per trade, justified by allegedly providing valuable research – of the sort, however, that can be obtained by reading the morning papers.

On the upside, my relationship manager (dafuq?) will buy me the most un-free lunch on the planet when I go see him. I also got a free umbrella. So there’s that.

Now tell me the game isn’t rigged.

I realize this will probably only resonate with a small portion of readers, but it is important to remember that the dysfunctions of finance are raping us all, and you always get the worst deal you are willing to accept. So don’t accept it. That’s what competition is for – unfortunately, banking bears all signs of a cartel. Fortunately the internet, advances in AI and the network-like nature of modern economy are starting to shake things up.

Conclusion

I predict that the bank of the near future is a server, a couple IT guys, two hipsters designing the brand identity in a Starbucks, and a small management team. Ideally, they and the hardware all fit in a minivan.

Everything else now is arbitrary expense for expense’s sake at the clients’ expense.

How large are the potential savings? Approximately as large as the costs of running the current cumbersome and bloated behemoths, that’s how large.

The ascendent principles of 21st century economics – interconnectedness, instant communication, no-hassle access to global markets and general spread-out, bottom-up, peer to peer crowdsourced goodness– spell doom for traditional middlemen. That is great news in general, and with regards to financial services in particular. Banking will have to fundamentally change to survive.

Which brings me to a big bold proposal: let’s connect the roles of depositor and shareholder. Thus, the share of your deposits on the bank’s capital will equal your share of ownership in the bank, and by extension your share of the profits. Depositing money will immediately and automatically translate into a proportionate ownership in the bank.

One advantage is that depositors are guranteed better returns. Second, depositor-shareholders will naturally want to drive down costs to make a buck, while keeping the core functionality of their business, lending at attractive but profitable rates. That’s a far superior structure of incentives than the present situation which essentially amounts to “fuck y’all, you have no choice anyway”.

Let’s protect the shareholder bank from takeovers by huge depositors by making the shares non-voting, and appointing an independent management team with rewards directly and transparently tied to performance. Checks and balances would need to be figured out, but technicalities and legalities aside, I see the shareholder bank as a viable and potentially far superior model to the current one. If I could get a banking licence without putting down the equivalent of a small country in capital, I’d do it in the blink of an eye. Warren, Elon, Mark, I am open to ouverture.